jefferson parish property tax sale

Parish Attorneys Office Code Collections 1221 Elmwood Park Blvd Suite 701 Jefferson LA 70123 Fax. The New Orleans Advocate contains the Judicial Advertisements and legal notices that the.

Coverdale Real Estate 24 Houses For Sale Point2

Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. 043 of home value. 11 rows STANDARD MORTGAGE CORPORATION VS THE UNOPENED SUCCESSION OF DORIS FRANCIS COOPER DECEASED.

Accelerating Real Estate Sales. Opry Mills Breakfast Restaurants. Find and bid on Residential Real Estate in Jefferson Parish County LA.

The Tax Sale is. Curbside garbage and recycling will run as scheduled on Monday May 30 2022. Uncover Available Property Tax Data By Searching Any Address.

You must submit your change of address in writing to the address below. The JPSO is tasked with the responsibility of seizing property that is in default and holding judicial auctions and sales on behalf of the creditor. The current total local sales tax rate in Jefferson LA is 9200.

Does anyone really fail to pay his or her taxes. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Search our database of Jefferson Parish County Property Auctions for free. Uncover Available Property Tax Data By Searching Any Address. The Tax Sale is held at the Jefferson.

Register for 1 to See All Listings Online. This is the total of state and parish sales tax rates. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

The jefferson parish sales tax is collected by the merchant on all qualifying sales made within jefferson parish. Total property taxes owed in jefferson for 2020 are 4351 million up 05. Jefferson Parish Transit will be running a normal schedule on Monday May 30 2022.

Can you tell me a little about the Tax Sale. Jefferson Parish County la. Search our database of Jefferson Parish County Property Auctions for free.

UPCOMING AUCTIONS. Ad Find Out the Market Value of Any Property and Past Sale Prices. Yes - Nearly 100 real estate property accounts are sold each year for delinquent taxes.

Jefferson parish collects on average 043 of a propertys assessed fair market value as property tax. Detailed listings of foreclosures short sales auction homes land bank properties. Jefferson Parish Adjudicated Property Auction.

Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. In an effort to recover lost tax revenue tax delinquent propertys located in Jefferson Louisiana are sold at the Jefferson Parish tax sale. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Adjudicated Property Auction to be Held Online on August 15 August 19 2020. For Properties Located on the. Welcome to the Jefferson Parish Assessors office.

The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county. Buy Foreclosed Homes and Save Up to 50. Jefferson Parish Assessors Office.

Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. 2022 - I3-Software Services. Get Property Records from 8 Building Departments in Jefferson Parish LA.

Click Here to view the latest Judicial Advertisement as published in The New Orleans Advocate. Tax delinquent propertys are sold to winning bidders. Jefferson Parish Assessors Office - Property Search.

Public Property Records provide information on. JEFFERSON LA The Jefferson Parish Adjudicated real estate auction scheduled for August. The sales are held each Wednesday at 10 am.

What is the sales tax rate in Jefferson Parish. Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana. The Jefferson Parish Sales Tax is 475 A county-wide sales tax rate of 475 is applicable to localities in Jefferson.

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is 92. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. The following local sales tax rates apply in jefferson parish.

Jefferson Parish Permits 822 South Clearview Parkway Elmwood LA 70123 504-736-7345 Directions. Jefferson Parish collects on average 043 of a propertys. Yearly median tax in Jefferson Parish.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

68 Bridlepath Street Richmond Hill Zolo Ca

Pros And Cons Of Selling Your Home To A Real Estate Investor

How To Find Tax Delinquent Properties In Your Area Rethority

Luxury Apartment Building Near Wrigley Field For Sale Multifamily Apartment Building Luxury Apartment Building Multifamily Property Management

Nora S Online Only Property Auction Brings In 2 9 Million Beats Expectations Interactive Map Local Politics Nola Com

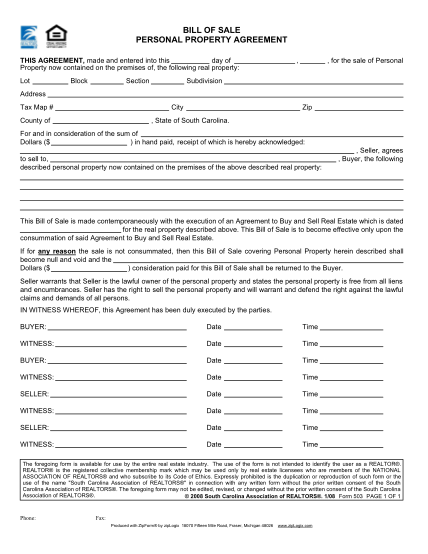

21 Bill Of Sale Template Pdf Free To Edit Download Print Cocodoc

Rothesay Real Estate 30 Houses For Sale Point2

How To Find Tax Delinquent Properties In Your Area Rethority

2019 Tax Sale City Of Opelousas

City 185 New Adjudicated Properties Available For Auction Biz New Orleans

Pin On Going To The Chapel And You Re

How To Find Tax Delinquent Properties In Your Area Rethority

![]()

Jefferson County Tax Office Tax Assessor Collector Of Jefferson County Texas

Mansion Monday Stunning Custom English Turn Home On Rosedown Court Mansions For Sale Mansions Custom Homes

2861 Tudor Ave Saanich Bc V8n 1l6 For Sale Re Max 903939

Kenner Condo Owner Survives Summary Judgment In Tax Sale Dispute Louisiana Personal Injury Lawyer Blog June 19 2019